The Value of Right-Brain Thinking in the Real Estate World

My very first job in commercial real estate was working for a regional investment and management company in Bethesda, Md. I was still in graduate school, and I was looking to get ANY experience and exposure to commercial real estate I could. I was also new to town, having moved from Alabama six months prior. To top it off, the market was going bananas, jobs were hard to come by, and my skill set at the time was limited. Luckily, a classmate of mine who was a commercial lender had just completed a deal with the principals of said firm and was willing to make an introduction.

My first interview was not a masterclass in negotiation but it did have the intended effect. I ultimately won over the firm’s three principals. Over our one-hour meeting, they grilled me on my technical abilities, discussing different scenarios they encountered as owners, investors, and managers. I did my best to synthesize the information and offer up some semblance of value in my answers. Near the end of our time, they asked point blank what experience I had. My answer was blunt: None.

The only technical abilities I had to offer them were six months of in-class education focused on commercial real estate and the ability to run a few basic valuation models. I could tell they weren’t impressed, so I went all in. I confidently told them that I may not have much experience, but I was willing to do whatever it took to succeed. I would be a sponge and was willing to learn anything they were willing to throw at me.

Crickets in the room.

So, I doubled down. I told them I’d work for free, for as many hours as they’d be willing to give me. And then I really jumped the shark. I told them that if they gave me a shot, they would be so pleased with the work I was doing that after two months they’d willingly start paying me. I’m not sure what part of my “pitch” landed me the job, but it was a pivotal moment for me.

The year I spent at Kenwood Management Company taught me a lot. I learned that personal reputation and how you treat people matters most, especially in real estate! I learned that most successful real estate investors don’t brag. Publicity may find them, but they aren’t boastful. That’s something that I’ve still found true 20 years later. Finally, I learned to read between the lines.

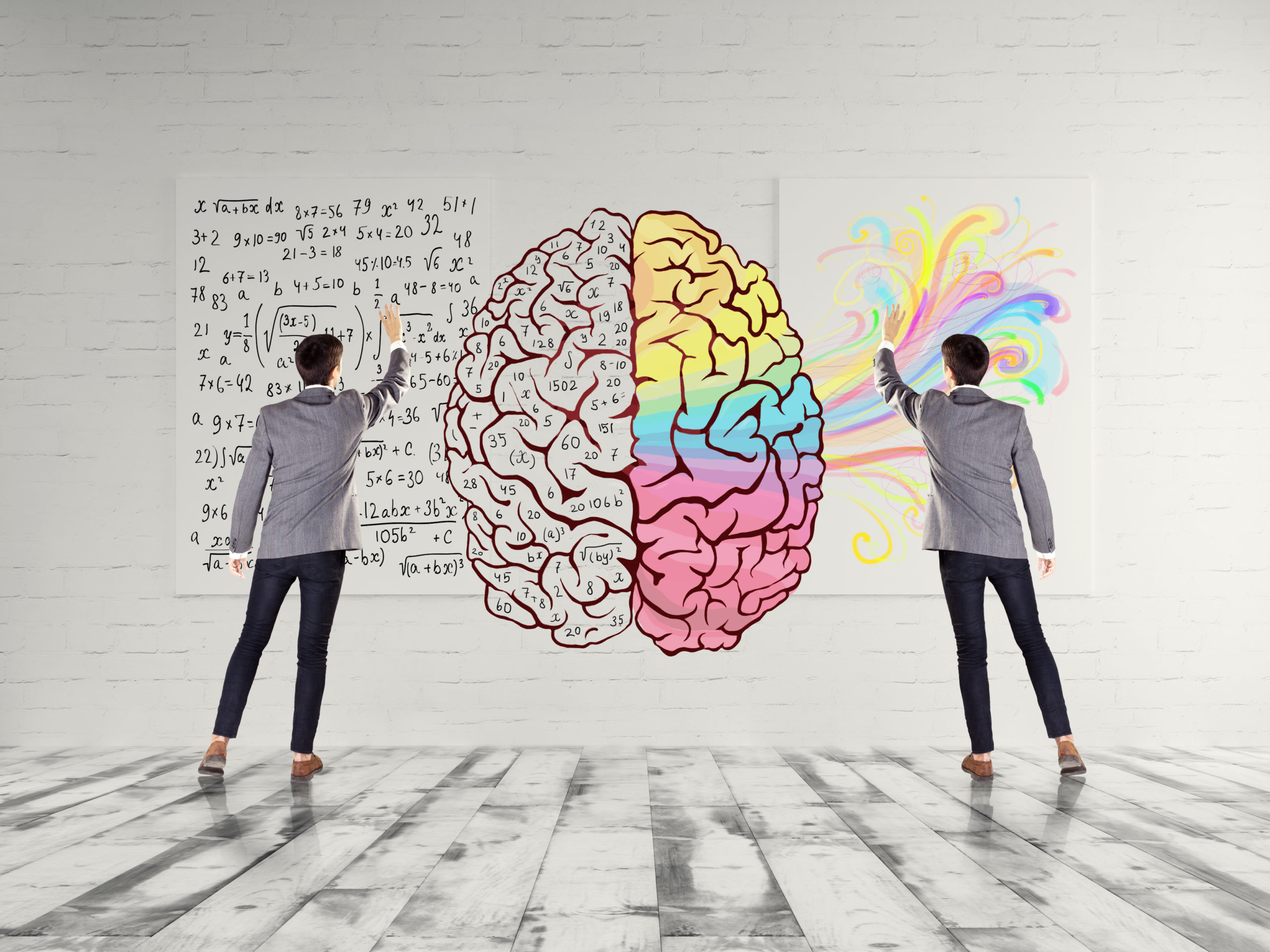

The real estate world is awash in data and trends. And many tend to take that data at face value. I was taught to synthesize that data to find correlations and stories within it; to engage in creative “right brain” thinking regularly. By doing so, you add value to your network, whether they be investors or customers, and you differentiate yourself personally and professionally.

I’ve done my best to operate under these same tenets over my 20-year career. And to a large degree, I have the dedication to right-brain thinking to thank for the birth of Cavalry. Left-brain thinking would have led me down the path of “why mess with a good thing” when it comes to the tax appeal industry. That “good thing” was the status quo in our industry: ignoring the potential of technology in the name of collecting high contingency fees for slow work. Right-brain thinking meant thinking differently by embracing technology to speed up the appeal process, revolutionizing the customer experience, and offering lower fees.

Now that I’m the grizzled real estate veteran giving the advice, I impart the same wisdom: even in a numbers-based, left-brain field like commercial real estate, your right brain thinking will be the variable that sets you apart.

BACK TO ARTICLES